Discover hidden quality growth companies with Long Equity's data-driven research

Gain access to Long Equity's investment analysis today for only $25/month or $250/year

When it comes to investment decisions and stock analysis, we believe that insights should be driven by data and data should be driven by insights. To understand out approach, start by taking a look at Long Equity Investment Methodology and our User Guide.

What we provide is best summarised by this recent feedback: “That's why I love following you, you talk about great companies I've never heard of.” "I thoroughly enjoy your work and find it to be practical, useful, informative and some of the best investment analytical work around."

Most investors drown in noise and rely on a combination of gut feeling and guess work. Consequently, they end up missing out on the next generation of quality growth companies. The solution is frequently updated data-backed insights that act as your bridge from uncertainty to clarity. Every metric, dashboard and note is designed to guide you toward confident quality growth investments

What's included?

For just $25/month (or $250/year), you get:

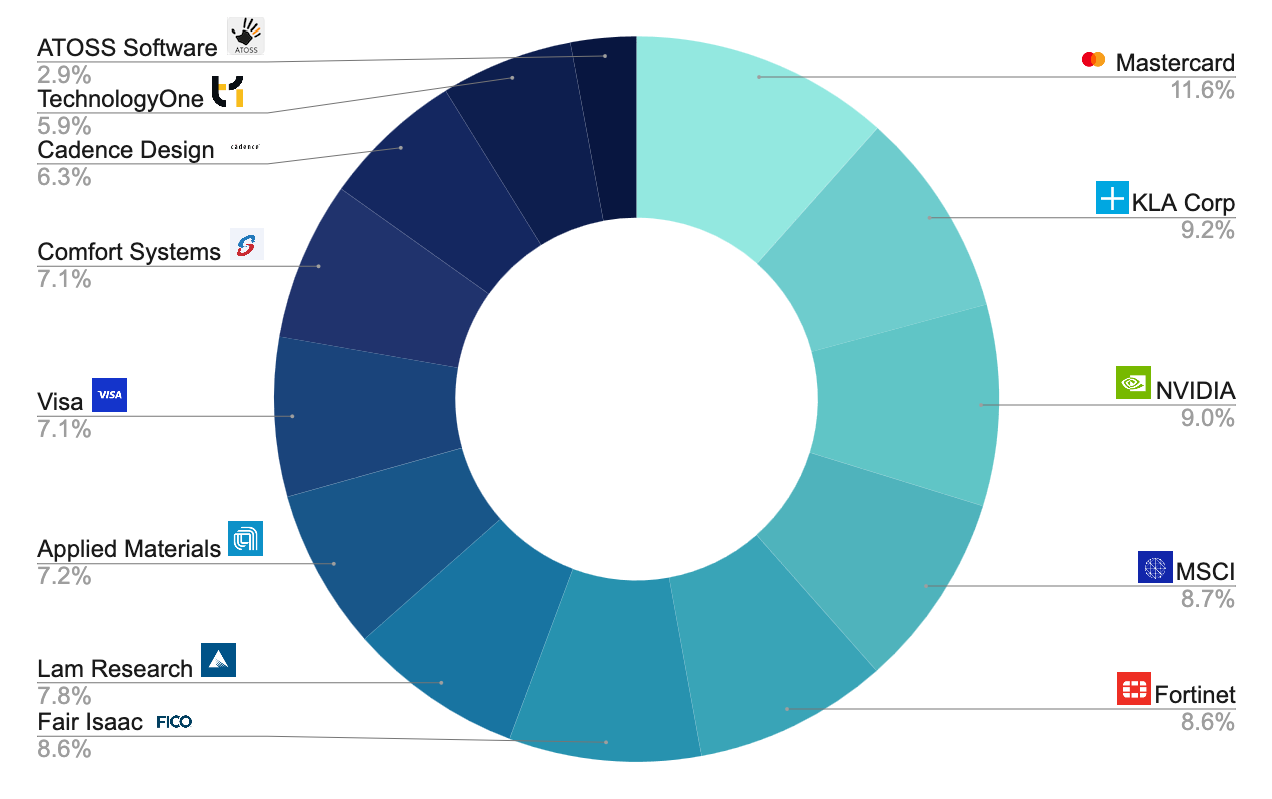

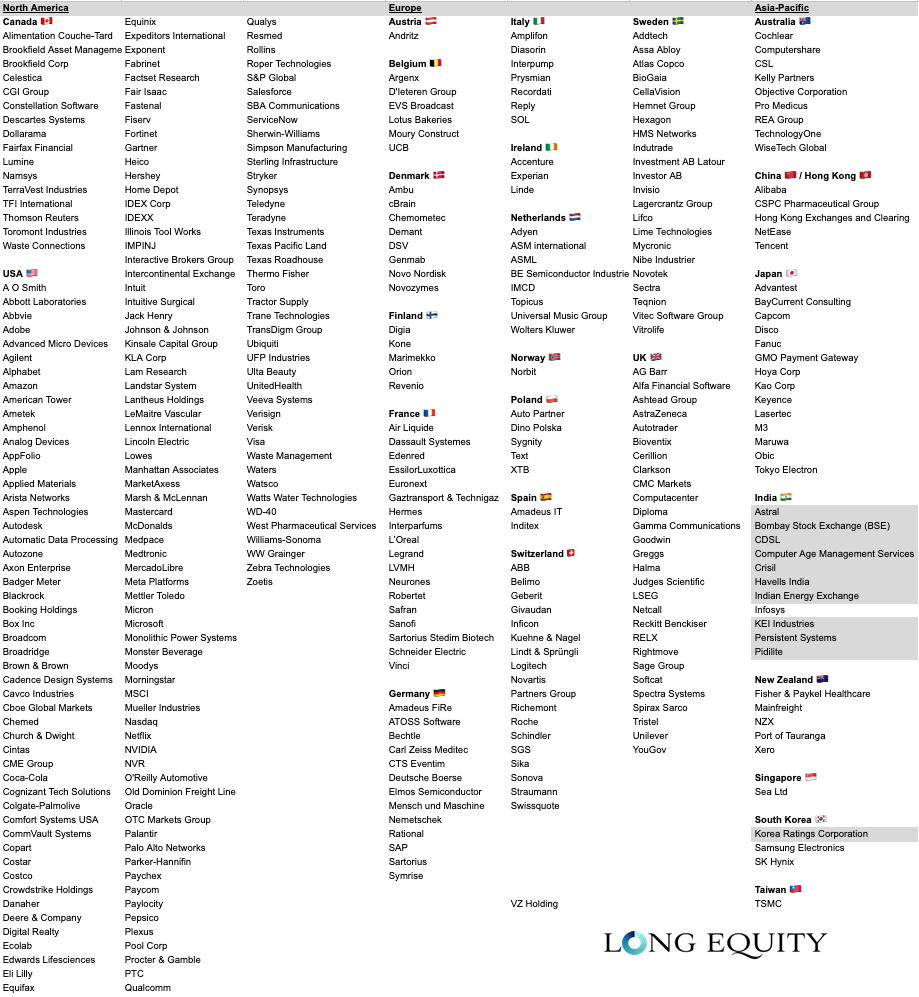

- The Global Compounders Database - Receive access to exclusive monthly stock-screen and spreadsheet covering over 300 companies, packed full of rare and insightful metrics to help you pinpoint the highest quality growth companies trading at the most attractive valuations.

- One research note per month into quality companies or an investment theme - Each month, I pick a company, country or investment theme, do hours of research and present the findings into an easy to read note. Here's an example research note on the German SAAS company Nemetschek.

- Portfolio and Investable Universe - Access a breakdown of the companies in the Long Equity Portfolio and Investable Universe. This includes access to our intuitive Quality Growth Dashboards of companies handpicked for their quality that track long-term trends, letting you to effortlessly stay ahead of market shifts.

Start finding hidden high-quality growth stocks now from $25/month:

Our research service is the perfect complement to "The Quality Growth Investor".

Payment

Payment is taken by Stripe and you can cancel at any time. If you have any questions, get in touch here: contact [at] longeq {dot} com

Step 1: Country specific research reports

Countries are routinely researched to unearth the best public companies in each market. Here are the notes published so far:

- 🇮🇹 Searching for compounders in Italy

- 🇮🇳 Searching for compounders in India

- 🇵🇱 Searching for compounders in Poland

- 🇧🇪 Searching for compounders in Belgium

- 🇨🇭 Searching for compounders in Switzerland

- 🇳🇿 Searching for compounders in New Zealand

- 🇳🇱 Searching for compounders in the Netherlands

- 🇫🇷 Searching for compounders in France

- 🇩🇰 Searching for compounders in Denmark

- 🇬🇧 Searching for compounders in the UK

- 🇨🇦 Searching for compounders in Canada

- 🇩🇪 Searching for compounders in Germany

- 🇦🇺 Searching for compounders in Australia

- 🇸🇪 Searching for compounders in Sweden

Step 2: Global compounders database

Whenever an interesting company is identified, it gets added to the "Global Compounders Database":

Note: Coverage for companies (in gray) is currently not provided.

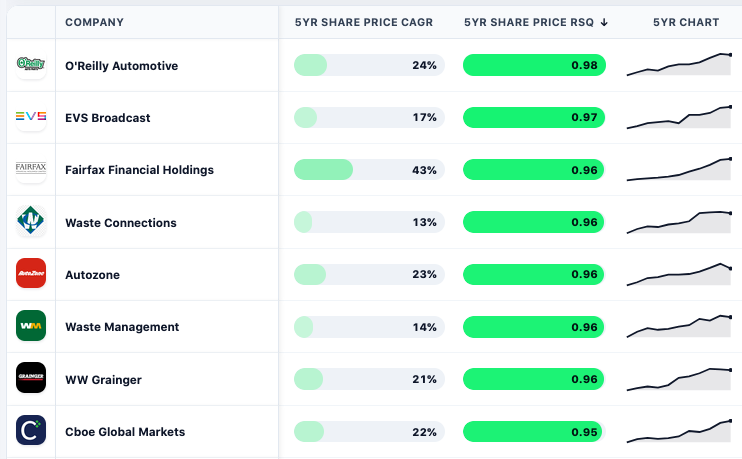

As not all financial data is relevant to investors, our database is designed to maximise the insights you can gather from it. Hence our emphasis on long-term data, bespoke ratios, linearity data and other data points not available elsewhere.

Here's a sneak peak of what the "Global Compounders Database" looks like:

Includes share price and linearity data:

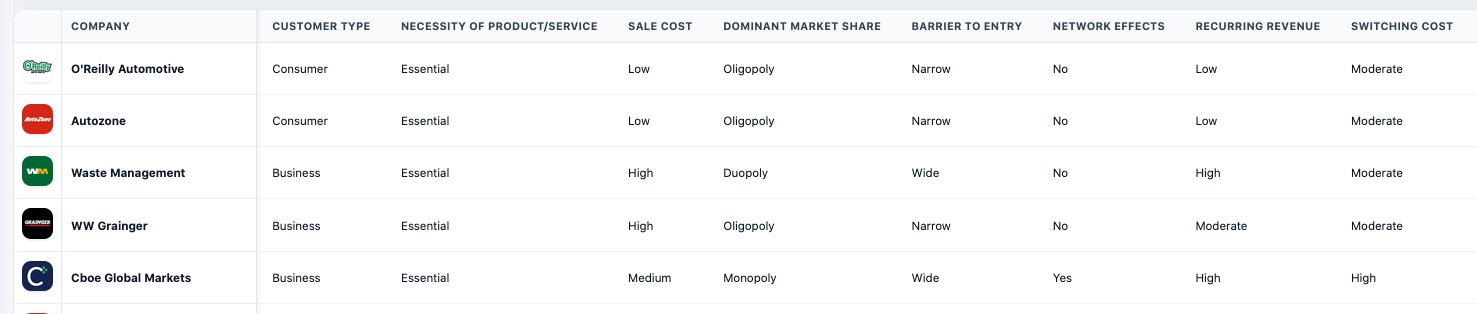

Includes a break down of each company's business model, including market share, barriers to entry and switching costs:

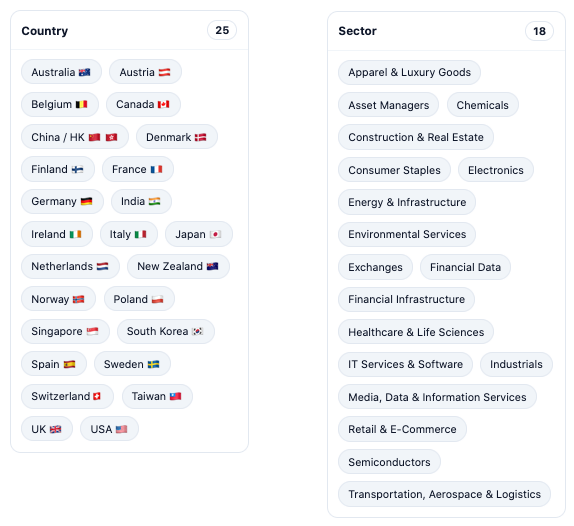

Includes 25 countries and 18 sectors:

Step 3: Company research notes

Above average companies from the Global Compounders Database are then further researched. Here are the notes published so far:

- Jan 26: Namsys

- Dec 25: Badger Meter (free)

- Oct 25: Broadridge Financial Solutions

- Sep 25: TechnologyOne

- Aug 25: Lam Research

- Jul 25: Comfort Systems USA

- Jun 25: Arista Networks

- May 25: Jack Henry

- Apr 25: GTT

- Mar 25: MSCI

- Feb 25: Maruwa

- Jan 25: KLA Corp

- Dec 24: Parker-Hannifin

- Nov 24: ATOSS Software

- Oct 24: Cerillion (free)

- Sep 24: Disco Corp

- Aug 24: Nemetschek (free)

Step 4: Portfolio and Investable Universe

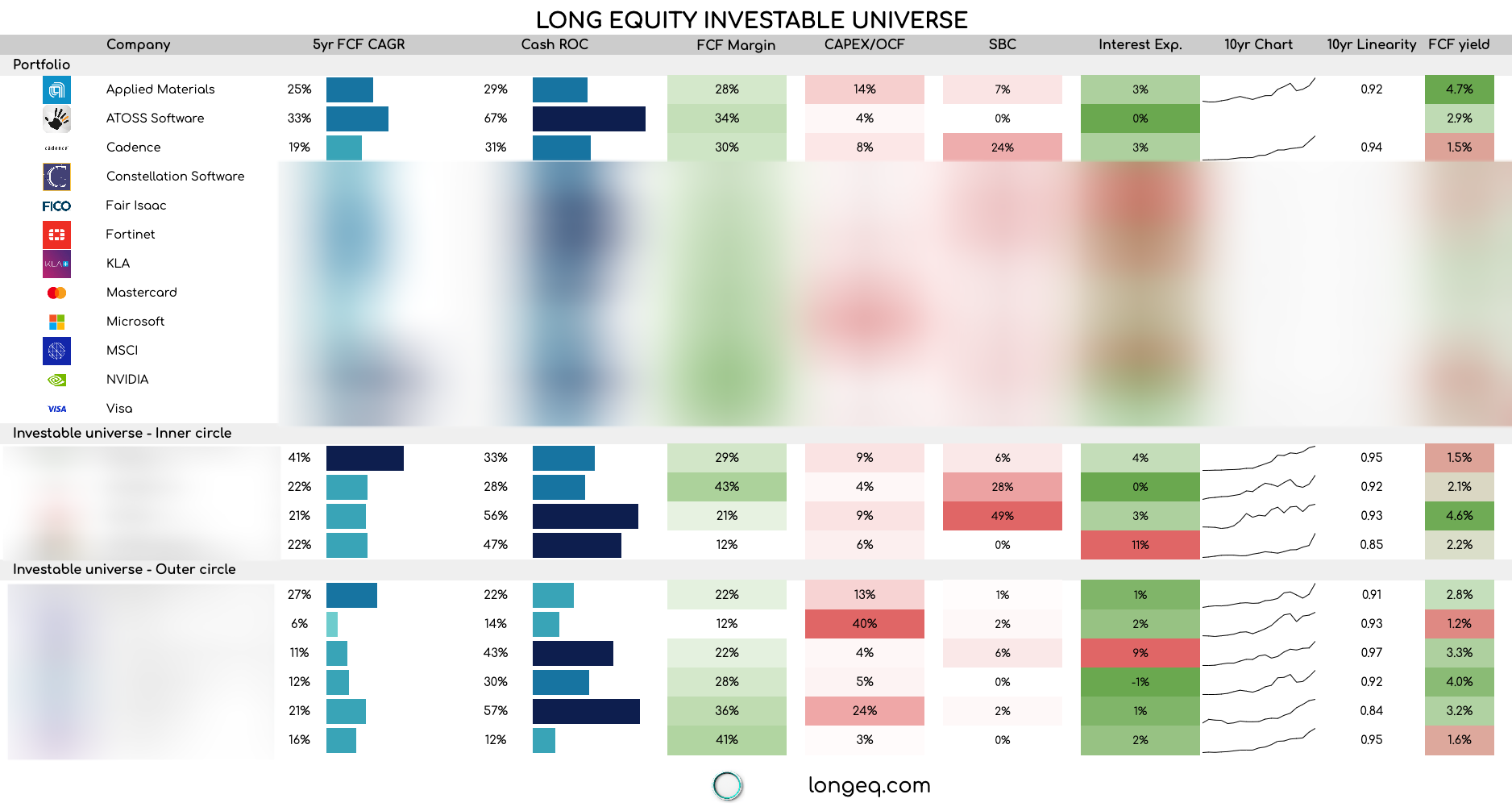

The best companies get added to the Investable Universe and the very best companies get invested in and become part of the Portfolio.

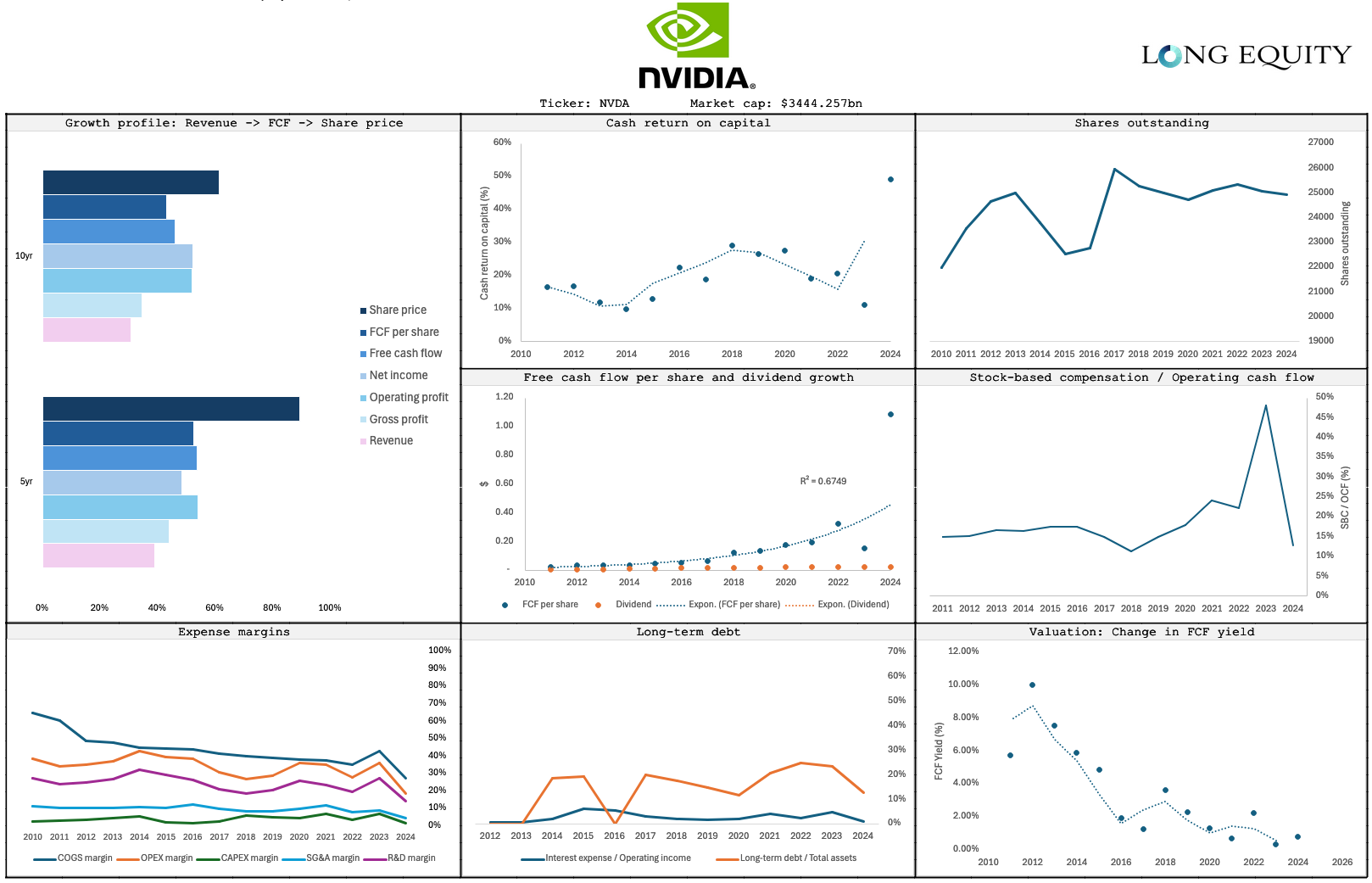

"Quality Growth Dashboards" are maintained for every company held in the portfolio and followed in the investable universe:

Here's what people are saying about Long Equity

The Quality Growth Investor

The data and insights available when you subscribe are the perfect compliment to my book "The Quality Growth Investor: The Ultimate Playbook for Quality Growth Investing". You can read what Chris Mayer (author of 100 Baggers) thought of my book here.

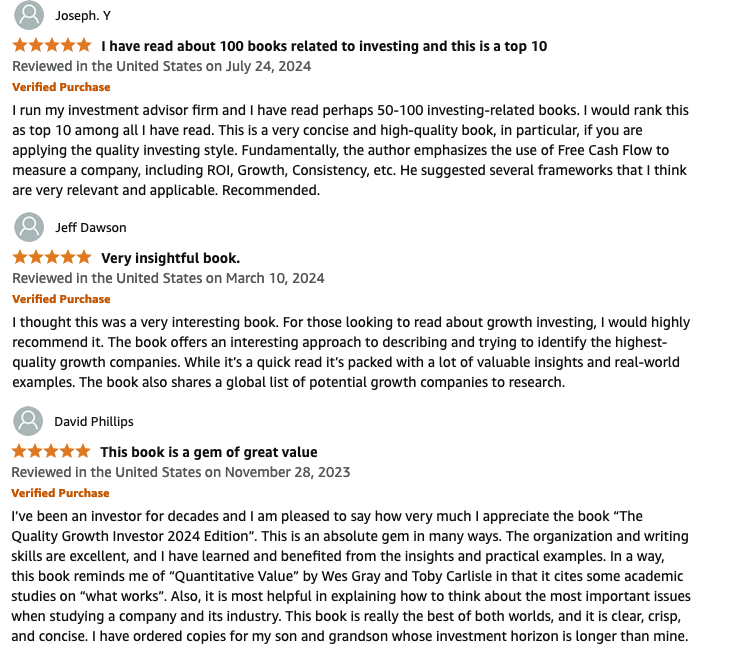

Here's a summary of some of the praise the book has recently received.

Disclaimer

The content published here is provided for information purposes only. It does not constitute any form of professional advice. It is not to be understood as an invitation or recommendation to buy or sell any of the securities mentioned. The presentation and commentary of investment strategies is not to be understood as an invitation or recommendation to replicate them. Investments in securities may involve significant market price volatility. The value of investments may go up as well as down. Past performance is not a guide to future performance. Before any investment decision is taken, if necessary, consult with a professional advisor.