Discover hidden quality growth companies with Long Equity's data-driven research

Gain access to Long Equity's investment analysis today for only $25/month or $250/year

In most years, quality investing outperforms the index. However, the difficulty with quality investing is that looking at a company's annual report alone doesn’t tell you whether it's a quality business. Quality investing requires comparison. We only know a company is a quality company when we compare it to every other company. This involves not just comparing a company to its peers, competitors, suppliers and customers, but also comparing it to companies nothing like it. Through systematic comparison we can find the truly exceptional companies that deservedly float to the top.

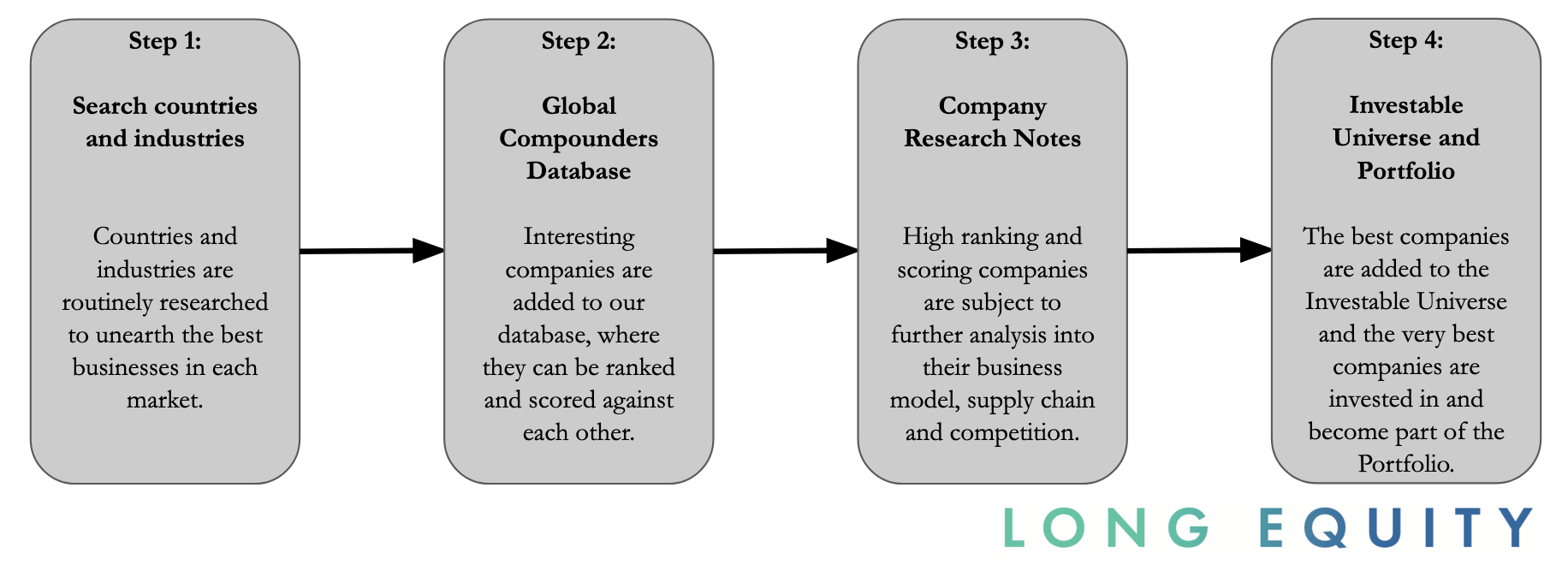

Here's where Long Equity comes in. Investors need a repeatable framework for sifting through companies, so they can discover the best opportunities at the best valuations. Long Equity is a clear, data-driven framework for identifying and tracking the world’s highest-quality growth companies.

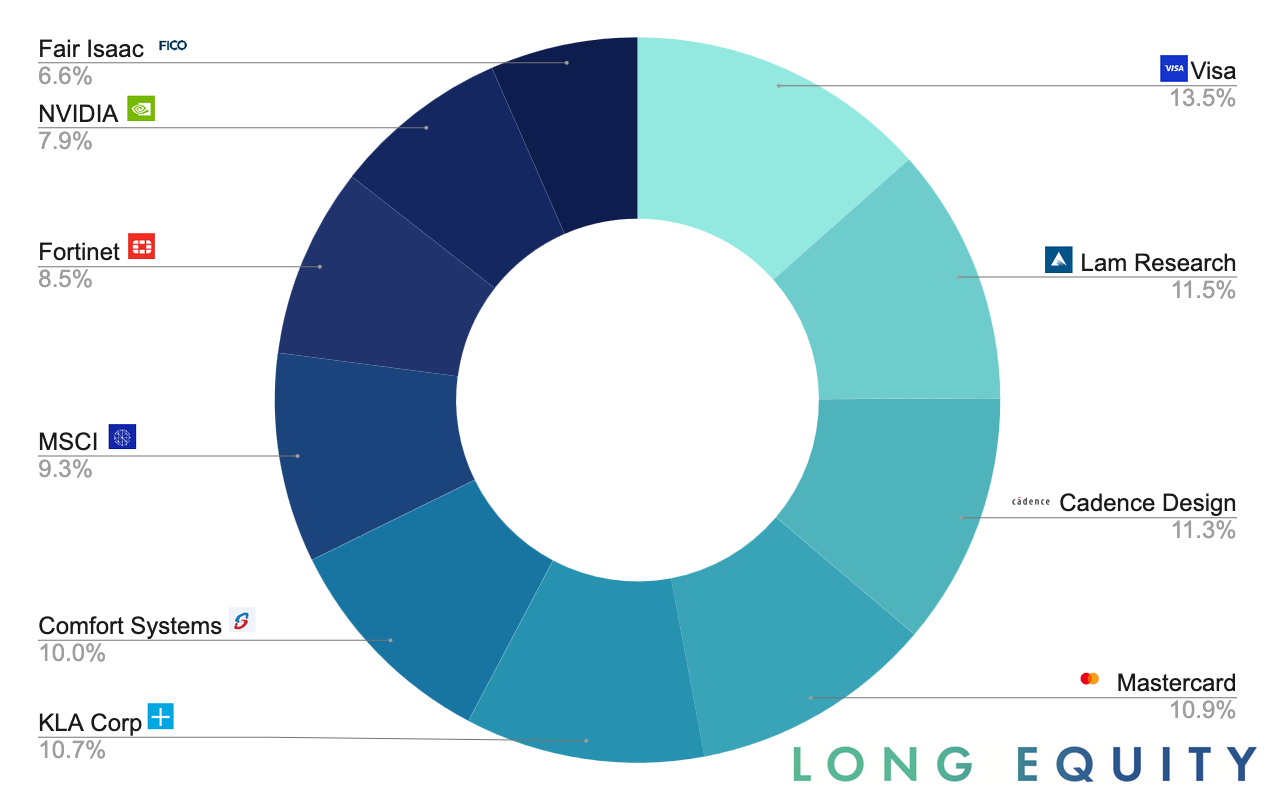

Note: The Long Equity portfolio accounts for 100% of my investable assets.

What's included?

For just $25/month (or $250/year), you get:

- Global Compounders Database - You get full access to our database and powerful stock screener tool covering over 300 companies, packed full of rare and insightful metrics to help you pinpoint the highest quality growth companies trading at the most attractive valuations. The data is also shared monthly as a spreadsheet.

- Portfolio Coverage - Every company in our database is researched, scored, and tracked through a structured process: from initial discovery, to investable universe, to portfolio inclusion. You get full access to updates to our "Investable Universe Dashboard", which covers our concentrated portfolio of high-quality companies and the accompanying watchlist of companies we're following. This includes access to our intuitive "Quality Growth Dashboards" that allowing you to monitor their long-term trends. To understand out approach, start by taking a look at Long Equity Investment Methodology and our User Guide.

- Research Service - Each month a company, country or investment theme is researched thoroughly. The findings are presented in an easy to read note. Here's an example research note on the German SAAS company Nemetschek and the US engineering company Badger Meter.

Start finding hidden high-quality growth stocks now for just $25/month:

Payment

Payment is taken by Stripe and you can cancel at any time. If you have any questions, get in touch here: contact [at] longeq {dot} com

Feedback

What we provide is best summarised by this recent feedback:

- “That's why I love following you, you talk about great companies I've never heard of.”

- "I thoroughly enjoy your work and find it to be practical, useful, informative and some of the best investment analytical work around."

Our research service is the perfect complement to our book: "The Quality Growth Investor".

Step 1: Country specific research reports

Let's take a deeper look at our investment framework.

For step 1, countries are routinely researched to unearth the best public companies in each market. Here are the notes published so far:

- 🇮🇹 Searching for compounders in Italy

- 🇮🇳 Searching for compounders in India

- 🇵🇱 Searching for compounders in Poland

- 🇧🇪 Searching for compounders in Belgium

- 🇨🇭 Searching for compounders in Switzerland

- 🇳🇿 Searching for compounders in New Zealand

- 🇳🇱 Searching for compounders in the Netherlands

- 🇫🇷 Searching for compounders in France

- 🇩🇰 Searching for compounders in Denmark

- 🇬🇧 Searching for compounders in the UK

- 🇨🇦 Searching for compounders in Canada

- 🇩🇪 Searching for compounders in Germany

- 🇦🇺 Searching for compounders in Australia

- 🇸🇪 Searching for compounders in Sweden

Step 2: Global compounders database

For step 2, whenever an interesting company is identified, it gets added to the "Global Compounders Database":

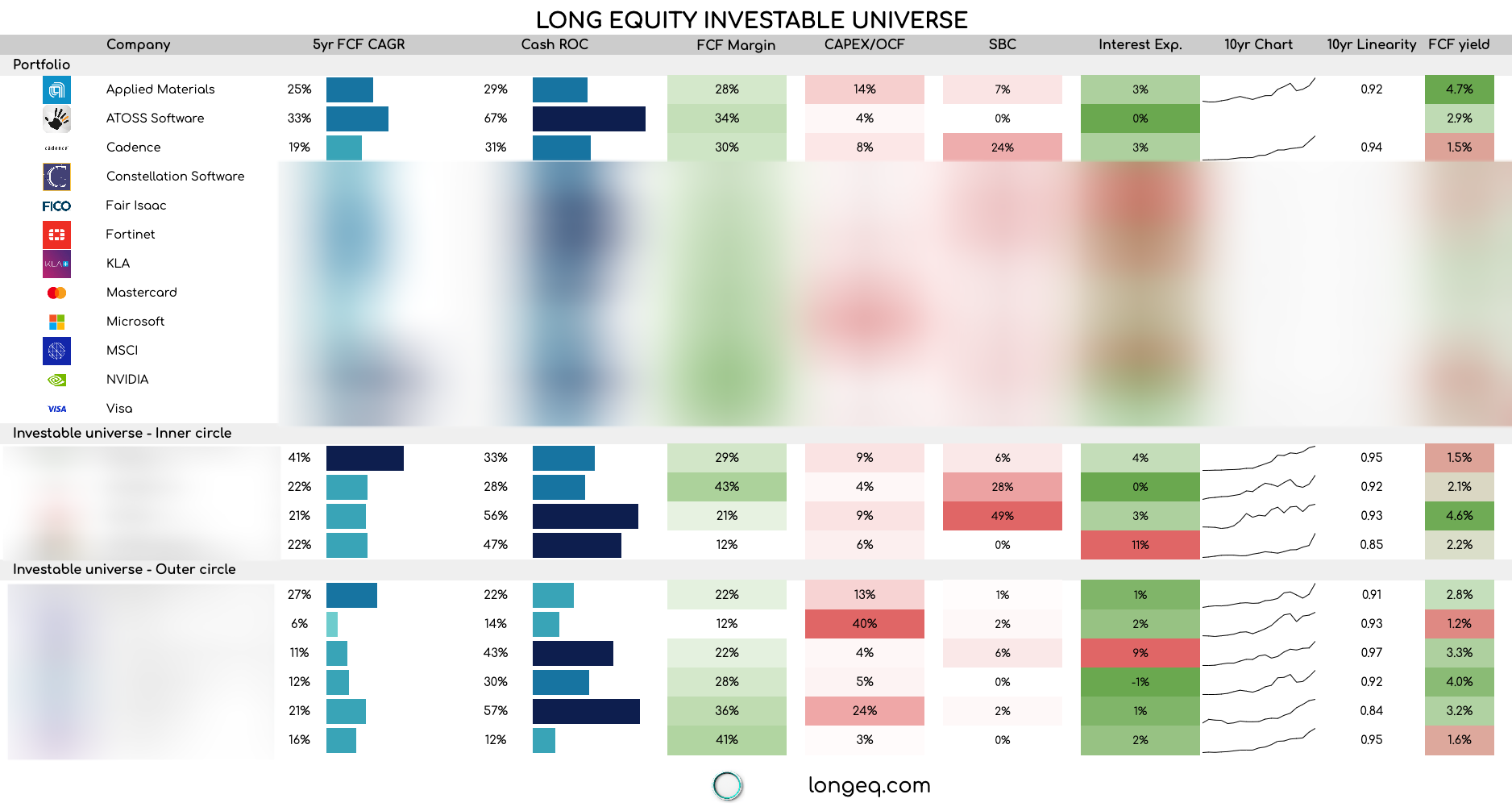

Note: Coverage for companies (in gray) is currently not provided.

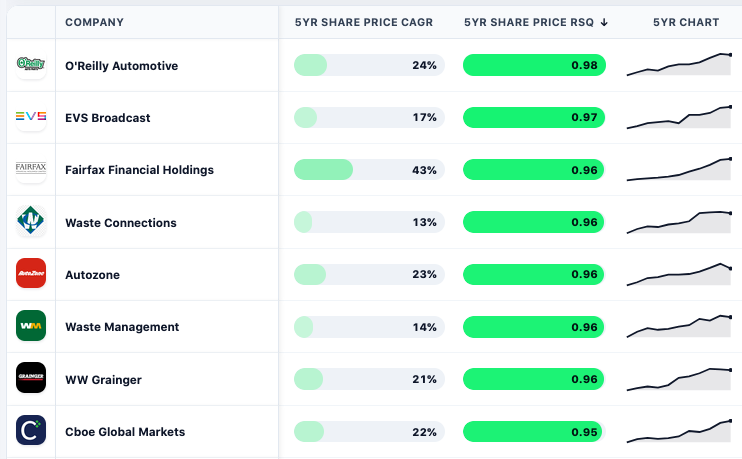

You can the search this list of companies in our database using our stock screener tool. We cover long-term trends, bespoke ratios, linearity data and other metrics not available elsewhere.

Here's a sneak peak of what the "Global Compounders Database" looks like:

It includes share price and linearity data:

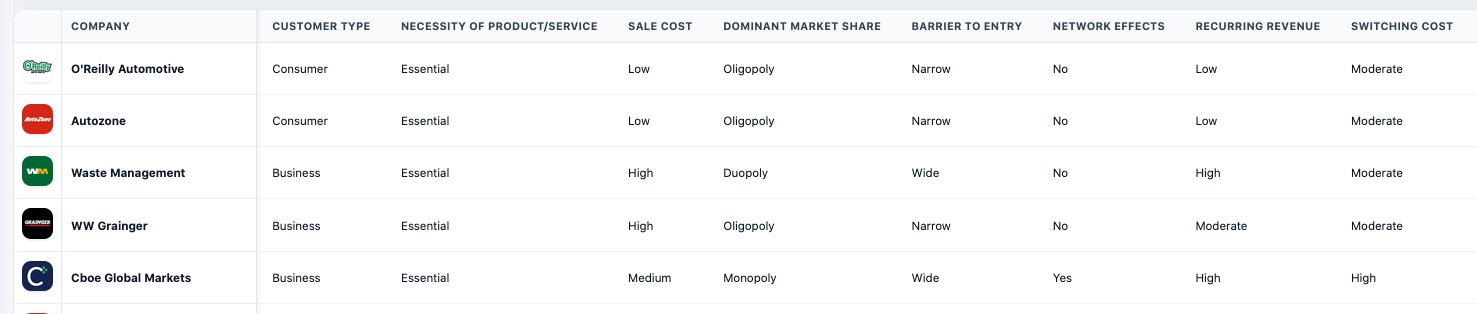

There's a break down of each company's business model, including market share, barriers to entry and switching costs:

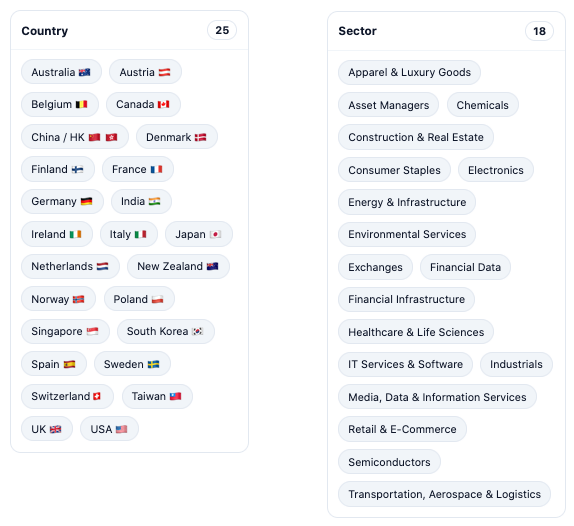

There's also coverage for 25 countries and 18 sectors:

Step 3: Company research notes

For step 3, we take a deeper look at the companies that are rank and scoring highly on our Global Compounders Database. Here are the research notes published so far:

- Jan 26: Namsys

- Dec 25: Badger Meter (free)

- Oct 25: Broadridge Financial Solutions

- Sep 25: TechnologyOne

- Aug 25: Lam Research

- Jul 25: Comfort Systems USA

- Jun 25: Arista Networks

- May 25: Jack Henry

- Apr 25: GTT

- Mar 25: MSCI

- Feb 25: Maruwa

- Jan 25: KLA Corp

- Dec 24: Parker-Hannifin

- Nov 24: ATOSS Software

- Oct 24: Cerillion (free)

- Sep 24: Disco Corp

- Aug 24: Nemetschek (free)

Step 4: Portfolio and Investable Universe

The best companies are added to the Investable Universe and the very best companies are invested in and become part of the Portfolio.

In most years, quality investing outperforms the index. One example of this is the MSCI World Quality index, which has beaten the MSCI World index in 9 of the last 14 years, and overall it has outperformed it by 3.15 percentages point since 1994. The MSCI World Quality index invests in the best 300 companies (the top 20%) from the 1500 companies in the MSCI World index. They’re ranked in quality based on how high their return on capital is and how stable their earnings are. The Long Equity strategy seeks to optimise and enhance this approach by using more than just two metrics for quality, and by investing in the top 1%, rather than the top 20%.

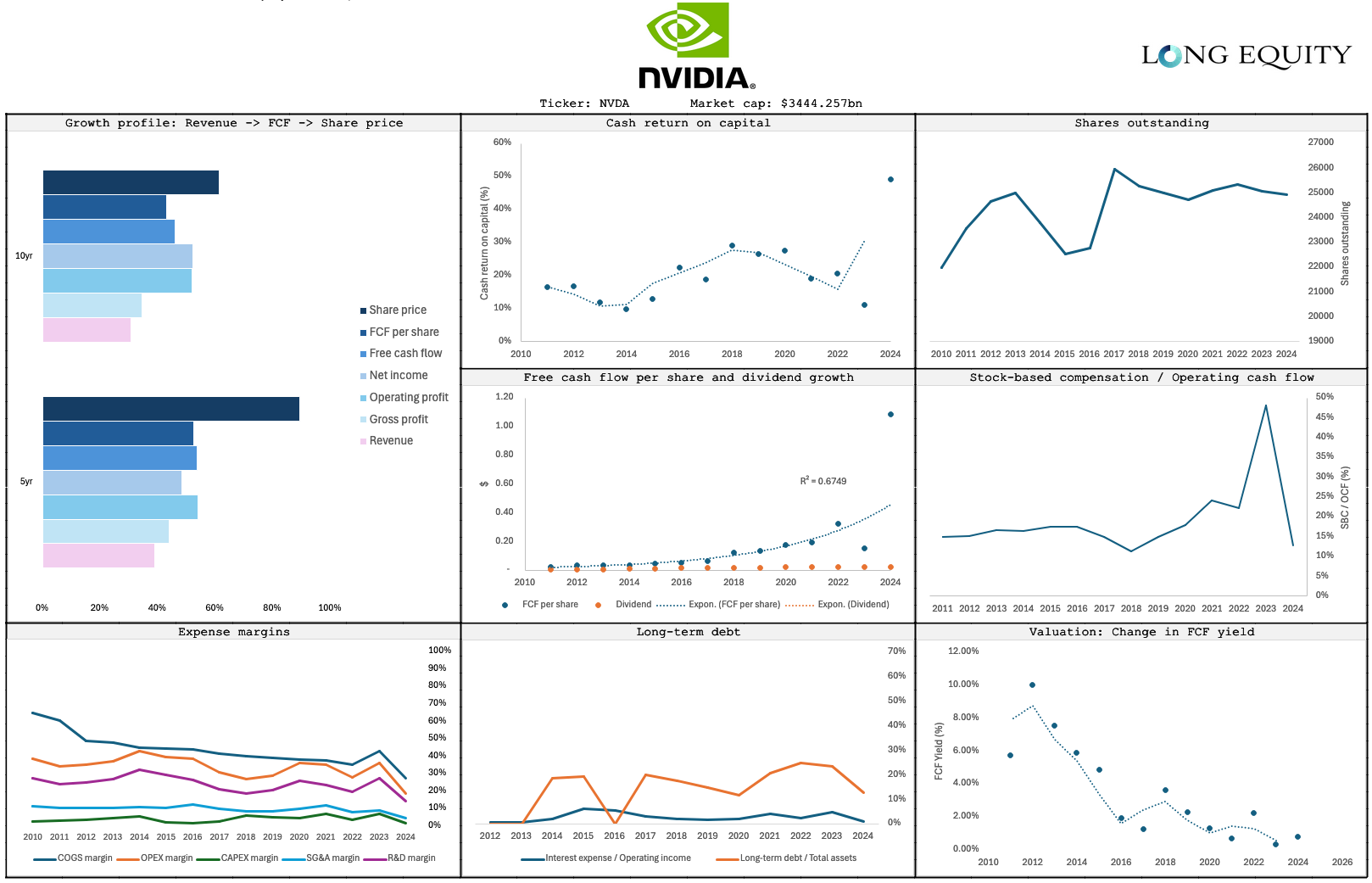

"Quality Growth Dashboards" are maintained for every company held in the portfolio and followed in the investable universe:

In short, the process can be summarised as follows:

Here's what people are saying about Long Equity

The Quality Growth Investor

The data and insights available when you subscribe are the perfect compliment to my book "The Quality Growth Investor: The Ultimate Playbook for Quality Growth Investing". You can read what Chris Mayer (author of 100 Baggers) thought of my book here.

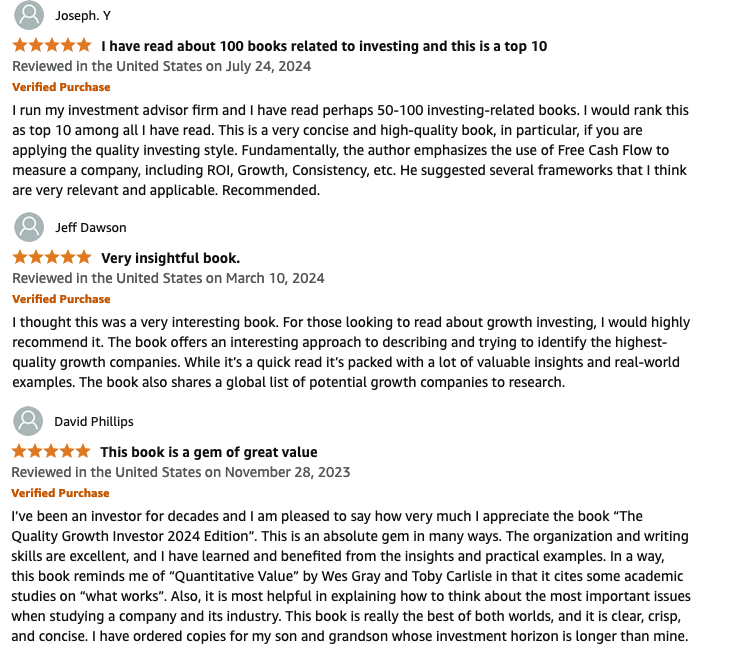

Here's a summary of some of the praise the book has recently received.

Disclaimer

The content published here is provided for information purposes only. It does not constitute any form of professional advice. It is not to be understood as an invitation or recommendation to buy or sell any of the securities mentioned. The presentation and commentary of investment strategies is not to be understood as an invitation or recommendation to replicate them. Investments in securities may involve significant market price volatility. The value of investments may go up as well as down. Past performance is not a guide to future performance. Before any investment decision is taken, if necessary, consult with a professional advisor.