🌬️ A Hidden Oligopoly Powering Decades of Quiet Growth

I’ve recently taken a closer look at a lesser-known corner of the industrial economy and discovered a textbook example of a global oligopoly hiding in plain sight.

It's the industrial gas sector, which is dominated by just four companies that have delivered consistent growth and impressive returns for decades:

- Air Liquide

- Air Products and Chemicals

- Linde

- Taiyo Nippon Sanso

Together, these companies provide essential gases like oxygen, nitrogen, and hydrogen to a wide range of industries: including healthcare, semiconductors, chemicals and energy. They have a critical role in everything from semiconductor fabrication to the transition to clean energy.

Here's a quick summary of why the economics of this sector has created decades of strong growth:

- The four businesses are embedded in the operations of their customers, creating a hard to disrupt switching cost.

- Their operations are capital-intensive, which has created a physical barrier to entry and scale that a newcomer would find hard/impossible to replicate.

- These barriers are made even higher by technical complexity, regulatory requirements and the need for dense distribution networks for the gas, which further prevents competition.

- Long-term contracts with industrial clients (often 10 - 15 years in length) provide stable, inflation-linked cash flows.

- Demand for industrial gas is both globally diverse.

The result of these factors coming together is a group of companies with unusually reliable earnings, strong returns on capital, and a track record of compounding quietly in the background.

Let's take a very quick look at each one.

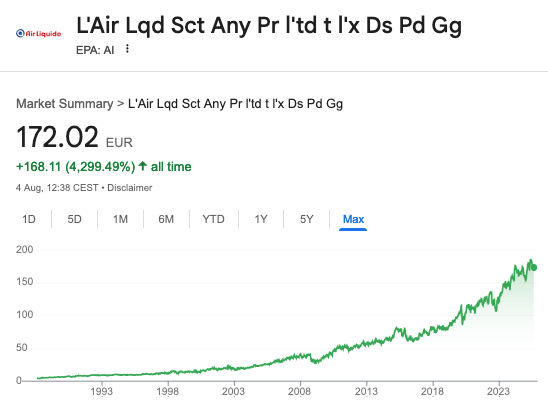

Air Liquide

Air Liquide was incorporated in 1902 and is headquartered in Paris, France.

- 10yr share price CAGR: 8% (RSq = 0.97)

- 10yr FCF CAGR: 10%

- Return on capital: 8%

Air Products and Chemicals

Air Products and Chemicals was founded in 1940 and is headquartered in Pennsylvania, USA.

- 10yr share price CAGR: 8% (RSq = 0.85)

- 10yr EPS CAGR: 14%

- Return on capital: 12%

Linde

Linde plc was founded in 1879 and is based in the United Kingdom.

- 10yr share price CAGR: 15% (RSq = 0.98)

- 10yr FCF CAGR: 15%

- Return on capital: 10%

Nippon Sanso Holdings

Nippon Sanso was established in 1910 and is headquartered in Tokyo, Japan.

- 5yr share price CAGR: 18% (RSq = 0.89)

- 10yr FCF CAGR: 11%

- Return on capital: 5%

For investors seeking long-term resilience backed by industrial substance, these four gas giants are worth a deeper look into.