Cerillion: Charging ahead in telecoms

October 2024

Disclosure: I don't own shares in Cerillion. At the time of writing, my portfolio consists of Applied Materials, Cadence Design Systems, Constellation Software, Fair Isaac, Fortinet, KLA Corp, Mastercard, Microsoft, MSCI, Novo Nordisk, NVIDIA and Visa.

History

Cerillion (LSE:CER) is a UK company listed on the UK's Alternative Investment Market (AIM), which is home to over 800 smaller UK companies. They provide mission-critical software as a service to telecommunications companies worldwide.

Cerillion business was initially part of the now defunct, once FTSE 100 company: Logica. Logica built bespoke billing solutions for a range of applications, which in 1980 included building a billing system for BT (British Telecoms). Louis Hall, the founder, CEO and largest shareholder (approx. 30%) led the management buyout of the original business from Logica in 1999. The company currently has a market capitalisation of £0.5bn. Louis sees his next key milestone being doubling this to £1bn. Something investors can certainly get behind.

Since floating in 2016, the company's shares have grown by over 2,100%. Louis Hall's puts this success down to the following philosophy:

"If you do what you say you're going to do and you then do better than you say you're going to do, then the market rewards that achievement".

Customers

Cerillion's customers are telecommunication companies (TelCos) operating worldwide. They currently have approximately 80 customers from across 45 countries.

Cerillion operates in a sector referred to as BSS/OSS, which stands for Back Office Support and Operating Systems Support.

Cerillion's customers can be classified as follows:

- Fully integrated network operator service providers

- Pure wholesalers

- Network wholesalers

- Usage wholesalers

- Messaging

- Standalone mobile operators

- Mobile virtual network operators (MVNOs)

- Mobile virtual network enablers - who enable MVNOs

Recent Cerillion customers include LINK Mobility and Virgin Media Ireland.

Customers also include some non-telcos, such as the healthcare company Resmed, who make use of Cerillion's platform to manage their own subscription service for respiratory products (link). It's interesting to see a potential opportunity for Cerillion to expand beyond telecommunications.

Products

Cerillion's software solutions are sold to telcos for billing, charging and customer management. Cerillion's products are used to create the products that telcos sell, which enables telcos to monetise their network infrastructure. They are used to onboard customers, to monitor and manage their customer's use of network assets, to bill for network usage and to manage the receivables that arise.

In short, their software controls how telcos connect their customers to their network, how their customers are onboarded and whether their customers can make calls and get an internet connection.

There are three key words that help understand Cerillion's products. They are: standardised, evergreen and headless.

Standardised: Historically, Cerillion's sector had been dominated by bespoke and tailored products. Whilst at Logica, Louis had the idea of moving from bespoke solutions built for each client, to building simpler, standardised solutions that could be resold over and over. Now at Cerillion, every customer has the same software, which provides cost savings and reduces their client's time to market.

Evergreen: Cerillion software is regularly updated with iterative improvements. They employ an Evergreen Software Model, which gives their customers instant access to new features and improvements (link). Customers are also given an opportunity to participate in Cerillion's roadmap of future product development.

Headless: Cerillion offers their functionality without a user interface (also known as headless). This means that developers can have complete control over their user interface (the front-end) and simply plug in to Cerillion's functionality via an application programming interface, or API (the back-end). This is particularly helpful for telcos when their own customers are already familiar with an existing layout, such as a mobile app or online platform.

Revenue diversification

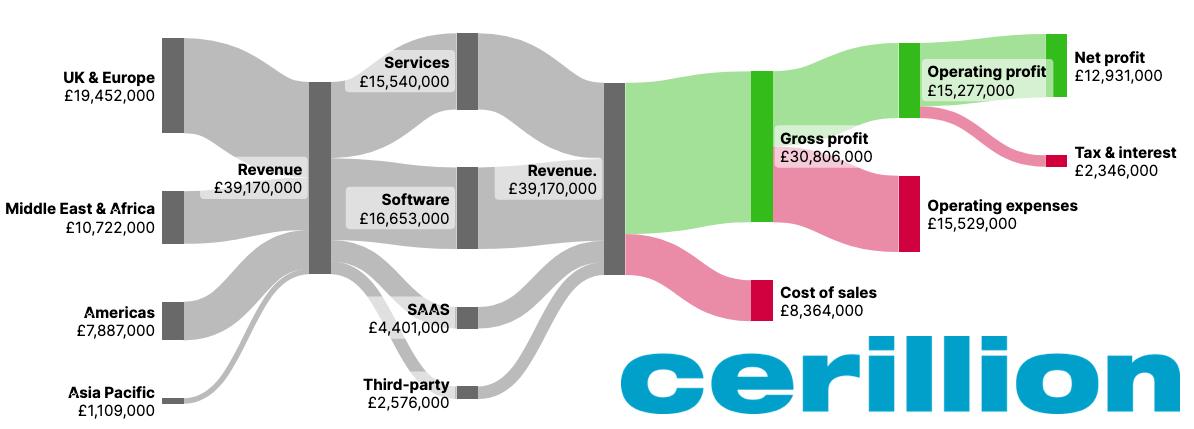

Cerillion's revenue streams are categorised into three segments:

- software revenue - this comprises software licences and related support

- services revenue - this is from software implementation and ongoing account development

- revenue from other activities - this includes the reselling of third-party products.

The risk factors from the annual report flag a couple of considerations to note. Firstly, as to be expected, the majority of their revenue is derived from the telecoms industry (although they are diversifying into other sectors, such as healthcare, e.g. Resmed). Secondly, 20% of their revenue is currently from a single customer and 80% of revenue is from just ten customers. Cerillion note they have a pipeline of potential future clients, so with time this concentration risk should be alleviated.

Cerillion's customers typically enter into 5 year subscription agreements with their customers. This results in a "sticky customer base" and means on average that Cerillion can fully expect their customers to renew. Under the accounting standard, IFRS 15, these subscriptions are recognised as licence revenue upfront.

Growth

Over the last year Cerillion has seen their total new orders increase by 32%. They have been expanding their operations into India and Bulgaria, and have been expanding their sales presence into Belgium, Singapore and the US.

Telcos are making major investments into 5G and fibre broadband, which should drive continued demand. Cerillion sees lots of parts of the telecoms market where they can be active.

Analysys Mason, one of the main analysts covering the BSS/OSS sector, anticipate that spending in the sector will grow at a rate of 3.5% per year. Spending is currently valued at $60bn annually. Their expectation is that the total addressable market (TAM) could soon be $70bn. Approximately $15bn of this is China, which Cerillion sees as being off limits. Given that Cerillion's revenue is currently less than 1% of TAM, Louis sees:

"enormous space for us to expand into".

Demand for the billing, charging and CRM solutions that Cerillion provides to telcos is driven by the need to:

- realise greater value from existing network infrastructures (increased operational efficiency)

- maximise value from new network infrastructure (e.g. 5G and fibre)

Cerillion remains well-placed to benefit from these growth drivers, both in Europe and internationally.

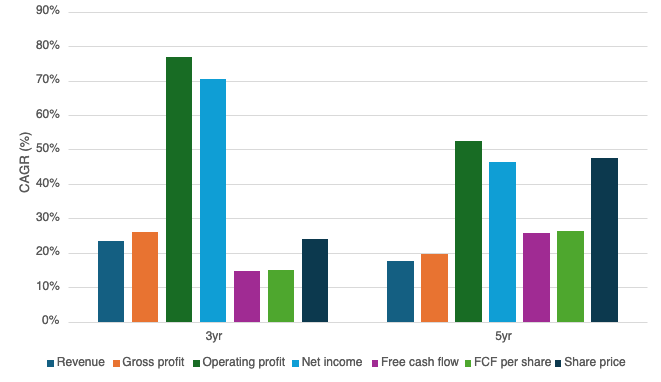

The below chart breaks down Cerillion's growth across revenue, gross profit, operating profit, net income, free cash flow, FCF per share and share price. Over the last 5 years, we've seen share price outpace both revenue and free cash flow growth, suggesting the company is now more expensive (we will deal with valuation further later).

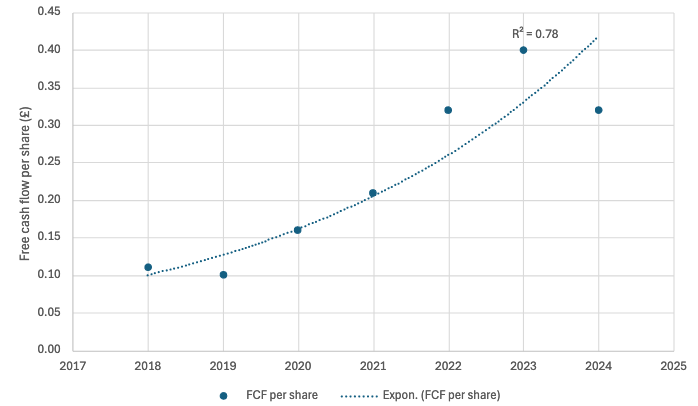

FCF per share has been going up at a near exponential rate, close to 25% per year. While the R-Squared value could be higher, it provides some support to the predictability of this business.

Competition

Cerillion has four main classes of competition:

- Independent software vendors - they provide tailored and service heavy solutions.

- Network equipment vendors - they also provide tailored and service heavy solutions. The main players here are Ericsson, Nokia and Huawei. Nokia uses some of Cerillion's modules, so Cerillion see themselves as more of a partner than a competitor. They do compete with Ericsson and the Chinese vendors, as they provide a full-service suite.

- Smaller independent software vendors - they focus on emerging markets, where competition is more on price and offering lower value.

- SAAS - they provide individual components. This includes vendors providing solutions for client-relationship management (CRM), charging, billing, service fulfillment and workflow. These services are typically provided as individual modules on a SAAS basis. They need to be made to work together using a large integrator, which is more expensive and can have a longer delivery time for the telco customer.

Given that Cerillion's customers are more expensive and more tailored, Cerillion looks to differentiate themselves by:

- offering a lower total cost

- offering a faster time to the market

The market Cerillion operates in is dominated by tailored and bespoke solutions that are customised to the needs of the client. Cerillion has differentiated itself by providing their clients with the same software, meaning they don't have to invest time in tailoring the software to their customer's needs. Instead, customers can customise the front-end themselves, whilst still tapping into Cerillion's platform using an API.

Can't telcos just develop their own software solutions? According to the CEO, customers don't appear to have the expertise or ability to develop their own solutions. They put this down to the decades of expertise and innovation that has gone into developing their products, which has required a huge amount of testing to ensure the software functions in real-time on network infrastructure. Cerillion expect that artificial intelligence will be able to increase the efficiency of their testing and fixing, which they are currently exploring.

Pricing power and barriers to entry

It's my view that there are several sources of pricing power for Cerillion.

- Firstly, Cerillion is a "revenue enabler" for their customers. Without Cerillion, their customers are unable to fully monetise their network assets. If Cerillion's software stops working, then the customers of telcos can't make calls. Cerillion's customers are unlikely to be incentivised to look for an alternative due to how mission-critical the product is.

- Secondly, Cerillion is low cost for their customers, meaning they are unlikely to be incentivised to look for an alternative based on cost.

- Thirdly, Cerillion provides a complex product. It requires testing and real-time network integration. This makes it harder for competitors to replicate.

- Fourthly, Cerillion provides a scalable product. They make it once and can sell it over and over.

- Finally, Cerillion enters into long-term contracts with their customers. This gives them predictable, recurring revenue. It also means that while contracts are in place, competitors will find it hard to take business.

Cerillion see themselves as having the following barriers to entry:

- Capability - Cerillion has spent a lot of time and resource fine-tuning their product. Cerillion's management team have significant expertise in the technology and telecoms sectors, which is difficult to replace.

- Credibility - Being chosen to provide a mission-critical service requires trust, which can only be earned over time. Cerillion has been chosen by a range of telcos to provide their mission-critical service. This means that potential customers wanting to speak to existing customers are given strong references.

Margins

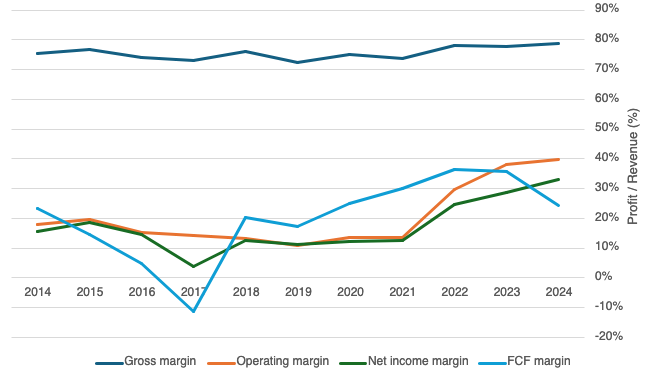

Cerillion admit that their business model benefits from operating leverage. Taking a deeper look at their expense margins reveals that Cerillion have been able to fuel some of their growth by getting their costs under control. Their expenses may have grown numerically, but in percentage terms, their costs have come down.

It's important to note that Cerillion's R&D expenditure is accounted for as a labour cost, hence it not being present above. The company dedicates 6,000 worker days to R&D per year, which equates to 15% of all employee time.

Profit margins are also pretty high. Note how the gross margin has remained consistently above 70% and how the operating margin has grown to 40% over the last few years.

Capital allocation and capital efficiency

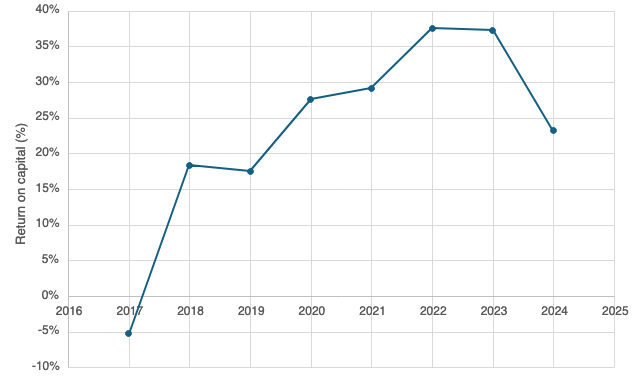

Cerillion's returns on capital have been consistently above 20% for several years now.

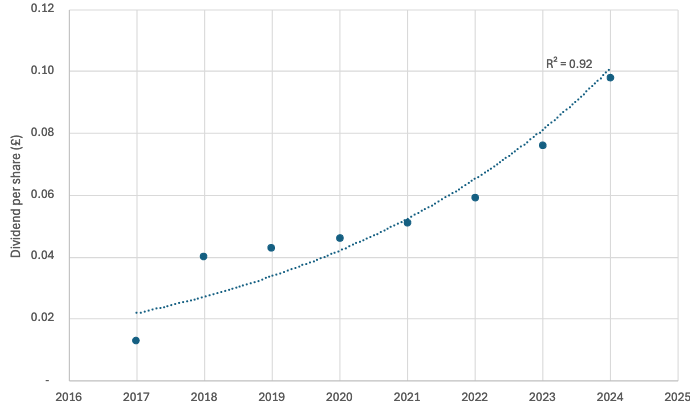

Cerillion's payout ratio is typically somewhere between 20% and 40%. This means that significant profits are retained and reinvested at these high returns on capital for the future. Cerillion started paying their dividend in 2017 and have managed to grow it exponentially at a rate above 15% per year.

Balance sheet strength

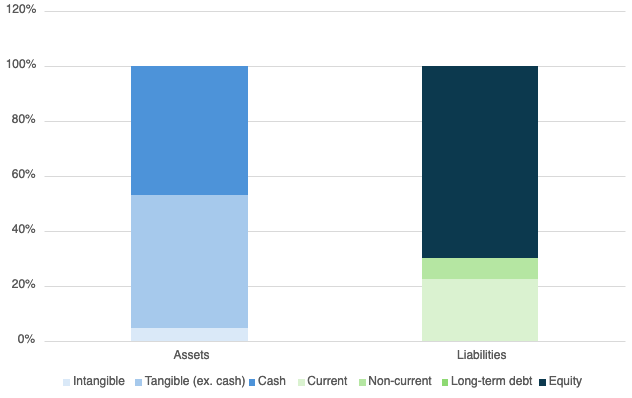

Cerillion has a fairly robust balance sheet. Approximately 47% of assets are in cash, compared to only 8% of liabilities being non-current and 0% long-term debt.

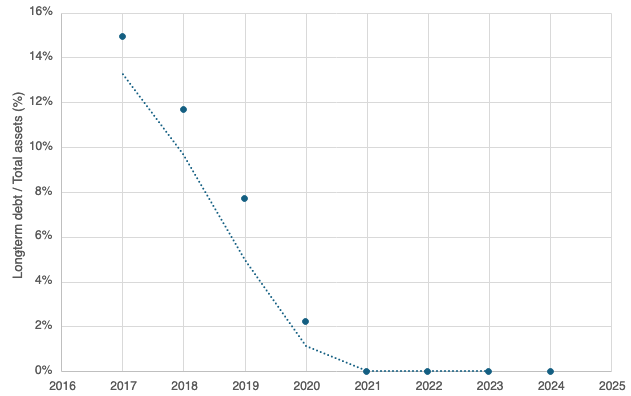

Long-term debt as a percent of assets has been 0% for the last few years.

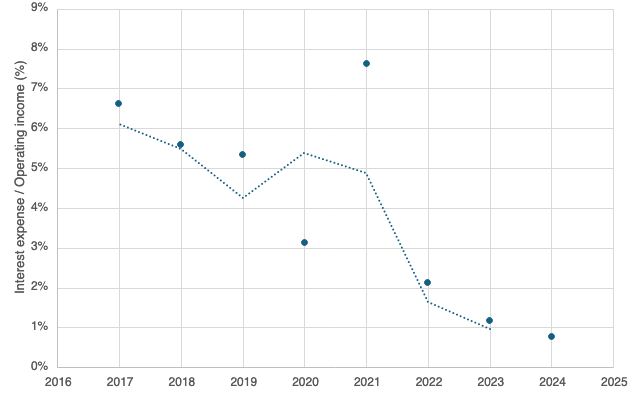

Not surprisingly, this has led to interest expense as a percent of operating income, dropping to under 1%.

This is a conservatively financed, cash-rich, balance sheet.

Valuation

FCF yield trend

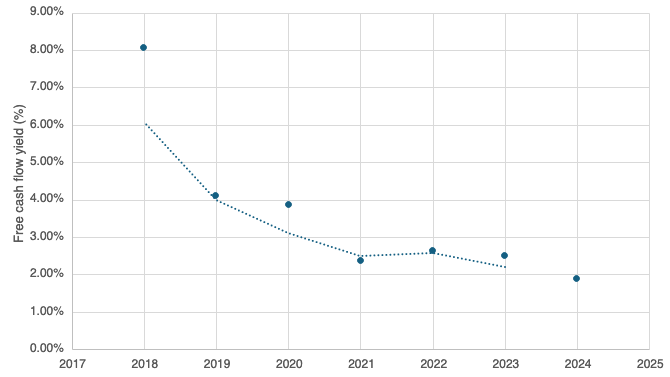

Given Cerillion's quality, growth opportunities and strong management, it's not surprising that this has been reflected in the company's share price. The FCF yield significantly dropped from 2018 to 2020, and has now dipped to below 2%.

What has moved the share price in the past - growth or valuation?

Over the last 5 years, Cerillion's share price has grown 47% per year. FCF per share has grown by 26% per year and the FCF yield dropped by 17% per year. So even though share price growth outpaced FCF per share growth, the majority of share price returns came from FCF per share growth, not a change in the FCF yield.

Is a realistic amount of growth required to reach a more attractive valuation?

Assuming the share price stays the same over the next 5 years, FCF per share would need to grow by 12% per year in order for the FCF yield to equal the S&P 500's current earnings yield of 3.33%. Over the last 5 years, Cerillion has grown its FCF per share by 26% per year, so such growth could be feasible. There are two interpretations of this. Either less growth is required in the future to justify the current price, or the market is pricing in less growth for the future. The latter seems unlikely given Cerillion's long-term drivers, recurring revenue, high returns on capital, wide margins and innovative business.