Finding quality in semiconductors

Driving the economy

Semiconductors are the foundation of all advanced technology and for developed economies, advanced technology has been the main driver of economic growth over the last few decades.

Historically, companies like IBM and Intel designed and manufactured their own chips, and even made the equipment needed to make their chips. Over time, the supply chain disaggregated. The division of labour and specialisation has led many semiconductor companies to becoming highly specialised, resulting in most segments of the supply chain featuring only two or three key players.

Investors have certainly benefited from the rise of semiconductors. The MSCI World Semiconductor index tracks the industry. Over the last 10 years, the index had an annualised return of 26.65%, compared to 10.07% for the far broader MSCI World index.

One long-term trend benefiting investors has been a decline in the industry's cyclicality. Historically, the industry's fortunes were tied to boom-and-bust cycles, driven by the fluctuating demand for consumer electronics. While still present, cyclicality has eased. This is due to the growing diversification of end markets, as semiconductors are now critical to a wide range of sectors. This includes the usual names, like AI and cloud computing, but has also been driven by demand from the automotive and healthcare sectors.

The semiconductor supply chain

The industry is best divided into the following four categories:

- Chip designers - e.g. NVIDIA and AMD.

- Chip manufacturers - e.g. TSMC and GlobalFoundries.

- Chip design tool providers - e.g. Cadence and Synopsys.

- Chip manufacturing equipment providers - e.g. Applied Materials, ASML, Lam Research and KLA Corp.

Chip designers and manufacturers are also further categorised as being either: Fabs, Fabless or IDMs.

- Fabs - Companies that focus exclusively on manufacturing chips are known as "Fabs" or "Foundries", reflecting that their business model is solely the fabrication of semiconductors. This includes TSMC and GlobalFoundries.

- Fabless - Companies that focus only on designing chips, but do not engage in manufacturing, are called "Fabless", due to the absence of in-house fabrication facilities. This includes NVIDIA and AMD.

- IDMs - Lastly, companies that handle both the design and manufacturing of chips are known as "Integrated Device Manufacturers" (IDMs), due to their integrated approach to managing the entire process from design to production. This includes Texas Instruments, Intel and Micron.

Finding quality in the supply chain

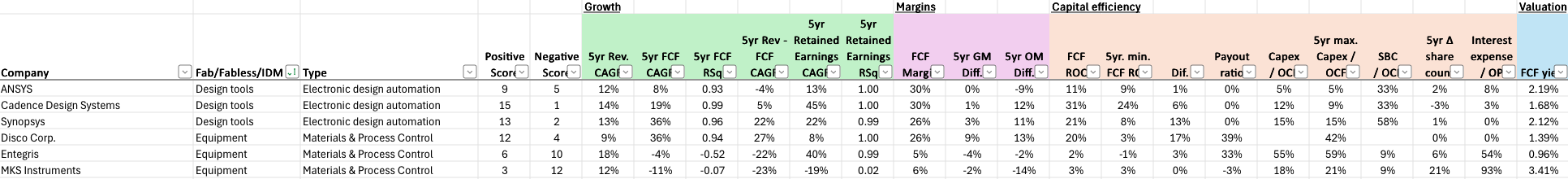

To help find the best quality in the semiconductor supply chain, I've just created and uploaded a new spreadsheet of data focused entirely on this industry. It features over 50 companies and covers chip designers, manufacturers and the providers of the tools and equipment that are essential to their design and creation.

In terms of quality, rising to the top are the design tool providers, the equipment providers and a range of fabless designers. The presence of these companies reflects their capital light nature and their recurring revenue business models, which has helped these businesses hedge the volatility stemming from the cyclicality of the semiconductor industry. The lack of IDMs and Foundries reflects their capital intensity of these companies.

So here are the names worth a look into:

Chip design tools

- Cadence Design Systems

- Synopsys

Chip manufacturing equipment providers

- KLA Corp

- ASM International

- Applied Materials

- Lam Research

Fabless chip designers

- NVIDIA

- Qualcomm

You can find the spreadsheet on the Exclusive Content page filed under "Other data". Here's a quick snapshot of the data.

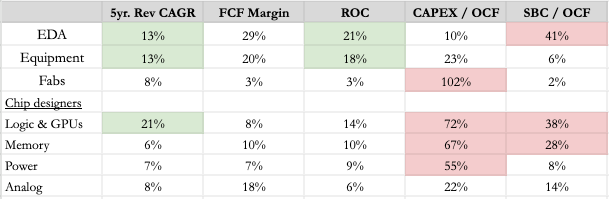

And here's a breakdown of the quality of each part of the supply chain:

- CAPEX: The highest capital expenditure is found in the fabs (so TSMC, GlobalFoundries). Although high levels are also found with chip designers.

- Stock-based compensation (SBC): High levels of SBC are found particularly with the EDAs (so Cadence and Synopsys), and also some of the designers (NVIDIA).

- Return on capital (ROC): High ROCs are found with the EDAs and equipment manufacturers.

- Growth: High revenue growth was found primarily with Logic & GPU designers (so NVIDIA).

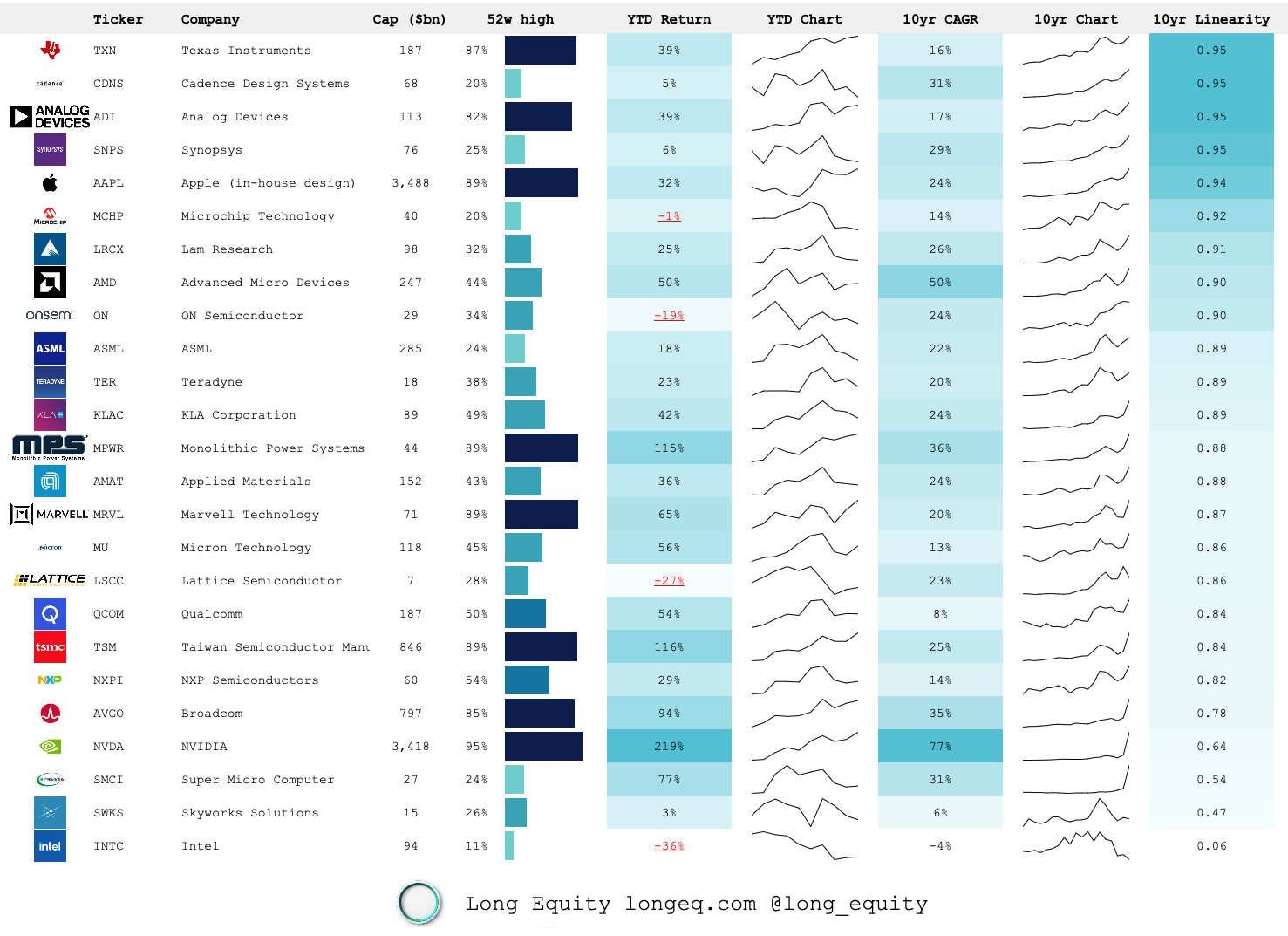

What about linearity?

Many semiconductor companies also display strong linear share price growth. Notable examples include:

- Texas Instruments

- Cadence Design Systems

- Analog Devices

- Synopsys

- Lam Research