Comfort Systems USA: HVAC's coolest operator?

I had two aims for this report: (1) to understand the Heating, Ventilation, and Air Conditioning sector (HVAC for short) and (2) to find the best company operating in it. The sector has become an incubator for several high quality growth companies - primarily because the economics of the sector lend itself to recurring revenues and pricing power derived from switching costs.

What is driving HVAC demand?

The HVAC sector is currently benefiting from the perfect storm of tailwinds, including structural growth, cyclical growth and technological growth. Here's a breakdown of the key growth drivers:

Driver #1: Non-discretionary demand

HVAC systems are critical infrastructure in homes, offices, data centres (such as those required for AI applications), hospitals, and factories. This demand is seen in both hot and cold climates. HVAC is not a “nice to have”. Rather, the sysetms are essential for comfort (i.e. residential and commercial property), health (i.e. clinics and hospitals), and the operation of high-tech equipment (i.e. industrial application). HVAC companies often operate with strong backlogs, booked months or even years in advance - especially for large-scale commercial projects.

Driver #2: Replacement cycles

HVAC firms don’t just make systems — they also install, maintain, and monitor them. HVAC systems require on-going servicing the replacement of parts and essential upgrades to new systems (typically every 10–20 years). This creates predictable recurring demand, particularly as replacement is essential - even during recessions - and regardless of whether the system is being replaced in a hot or cold climate. HVAC services and distribution don’t require massive capex, and therefore many HVAC companies are capital light businesses.

Driver #3: Vertical Integration

Players like Watsco (distribution) and Comfort Systems USA (installation) have grown by acquiring smaller firms. This has created economies of scale, pricing power and margin expansion - and enables them to offer end-to-end solutions from design to maintenance, building customer loyalty.

Driver #4: Energy efficiency

Governments and corporations are investing heavily in both decarbonisation and energy efficiency. Climate change is driving hotter summers and colder winters, increasing the need for HVAC solutions globally. Urbanisation in developing countries (e.g., India, Southeast Asia) has led to a surge in air conditioning demand.

Players in the HVAC sector

Having consider the strong economics of the sector, let's consider some of the main players.

Watsco: Watsco is the largest distributor of HVAC equipment in North America, serving contractors rather than manufacturing its own systems.

Trane Technologies: Trane specialises in sustainable HVAC systems/services, particularly for large-scale commercial buildings and industrial operations. They distinguish themselves through a focus on decarbonisation and intelligent systems, integrating advanced controls and analytics to optimise building performance.

Comfort Systems USA: Comfort Systems USA is one of the largest HVAC installation and services contractors in the US, focusing on commercial and industrial projects. Their decentralised operating model of regional contracting companies stands out and enables locally tailored service backed by national scale.

Lennox International: Lennox focuses on residential and light commercial HVAC solutions, with a reputation for reliable, energy-efficient systems and strong dealer relationships. They differentiate themselves on vertical integration and premium branding, controlling manufacturing, distribution, and sales in a tightly managed ecosystem.

Johnson Controls: Johnson offers HVAC equipment alongside building automation and security solutions, giving them a holistic edge in smart building integration.

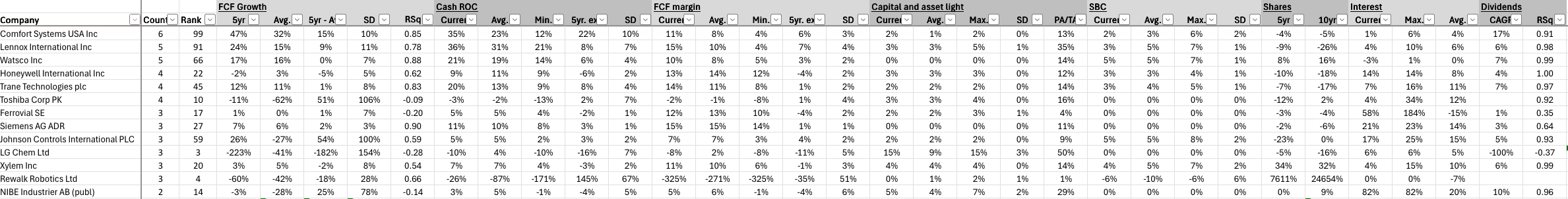

Having identified the main players, I then ran the names through my quality filter.

While Lennox also looks strong, Comfort Systems USA stood out the most for a whole host of reasons - including (i) strong financials, (ii) trading at an attractive valuation, and (iii) a business model that appears on the surface to be similar to Constellation Software (my largest holding) - in that they run a decentralised operating model.

The remainder of this report will consider the business model of Comfort Systems USA.