Nemetschek: Pioneering Digital Transformation in Architecture and Construction

August 2024

Disclosure: I don't own shares in Nemetschek. At the time of writing, my portfolio consists of Applied Materials, Cadence Design Systems, Constellation Software, Fair Isaac, Fortinet, KLA Corp, Mastercard, Microsoft, MSCI, Novo Nordisk, NVIDIA and Visa.

Summary

Nemetschek SE (ETR:NEM) was founded in 1963 by German engineer, and still majority shareholder, Professor Georg Nemetschek (born 1934). Nemetschek is a leading provider of software for architecture, engineering, construction and operations (AEC/O). Headquartered in Munich, Germany, Nemetschek is predominately owned by the Nemetschek family (directly and through foundations), with only 49.1% publicly available. Nemetschek has been listed on both the MDAX (a mid-cap German index) and TecDAX (a tech focused German index) since 1999 and has seen its share price grow by 1,548% since then (compared to 319% for the S&P 500 over the same time period).

Today, Nemetschek is a holding company for 13 different brands (essentially subsidiaries) covering the design, building and management of buildings and infrastructure, as well as providing selling to the media and entertainment industry. There is central management at the group level, which houses core functions, such as IT, HR, legal and finance. This allows for a high degree of freedom at the subsidiary level.

Products

Nemetschek's products empowers professionals (whether they be architects, bridge engineers, project managers or construction managers) to efficiently design, build, visualise and manage. Perhaps you're designing a building and you want to optimised the position of the windows, Nemetschek's Vectorworks solutions allows you to:

"the position of the sun and its angle of incidence can be simulated with digital solutions, making it possible to plan windows optimally."

Nemetschek's businesses are grouped into the following four segments: Design, Build, Manage and Media. Design (such as Allplan and Vectorworks) covers the use of computer-aided design and computer-aided engineering for the design and visualisation of buildings of infrastructure. This is primiarily used by architects, designers and engineers. Build (such as Bluebleam) covers the bidding and award process, as well as budgeting, invoicing and costing. This is primarily used by construction companies and contractors. Manage (such as Spacewell) is used for property management by property managers. Media (predominately Maxon) is used for 3D modeling, animation and rendering for film and video games.

Supply chain

Nemetschek's operations are primarily software-based, meaning that their supply chain needs are focused on digital infrastructure, software development tools, and cloud services. While Nemetschek does not rely heavily on physical goods, it sources essential technology components such as servers, cloud storage, and development platforms from leading tech providers. This allows the company to keep margins low.

Revenue

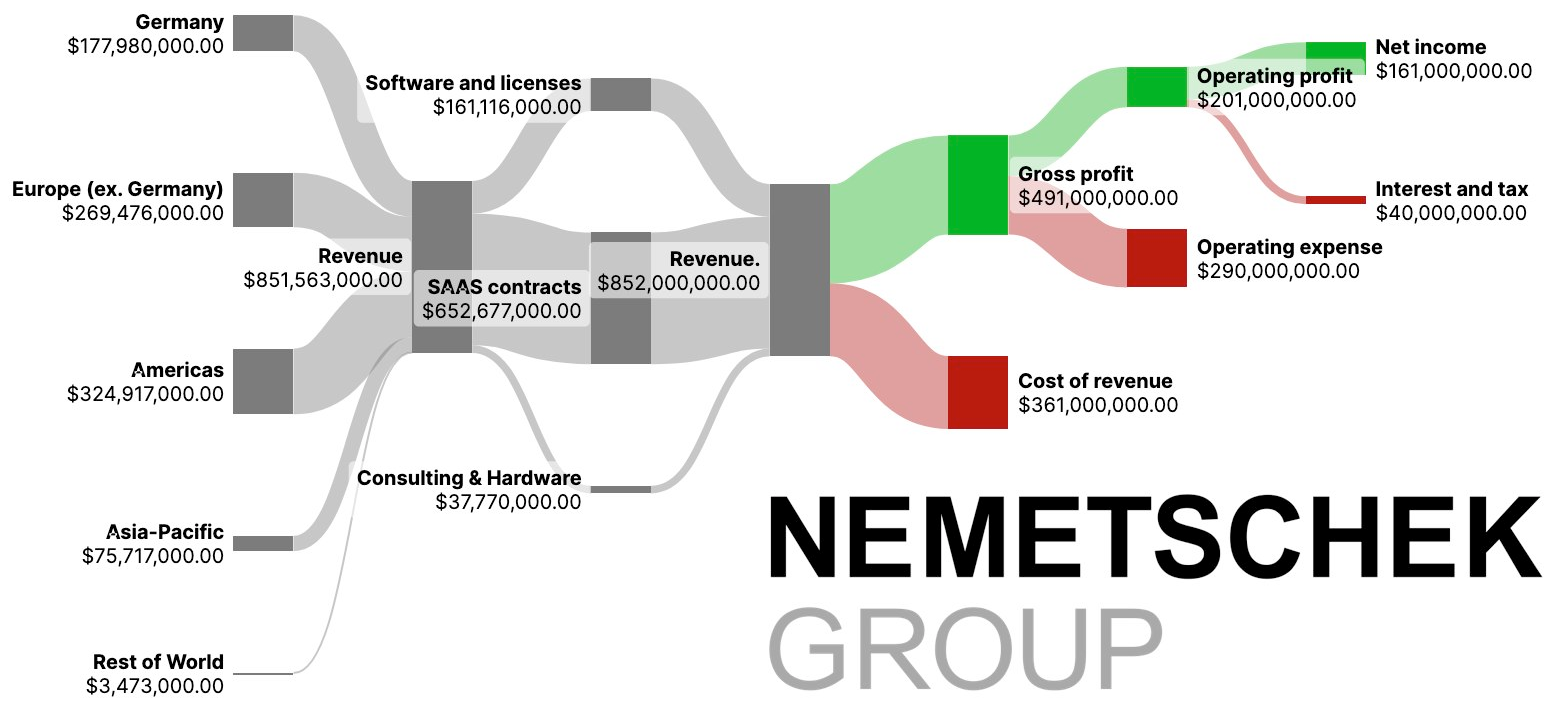

Nemetschek has a fairly diversified and recurring revenue stream. They have around 7 million users from across 142 countries. Many of Nemetschek's brands are still transitioning to the SAAS, meaning that revenue should continue to become even more recurring in the years to come. The below Sankey diagram provides a geographic and product/service breakdown of the company's revenue. It demonstrates that Nemetschek is fairly diversified globally, with the majority of their revenue coming from long-term SAAS contracts.

Competition

Nemetschek faces competition from several major players in the AEC software industry, most notably Autodesk, Bentley Systems, and Trimble. Autodesk is perhaps its most significant competitor, offering solutions such as AutoCAD and Revit, which are widely adopted across the AEC industry. Bentley Systems is also a formidable rival, especially in infrastructure projects and focuses on integrated design and project delivery. Trimble competes closely in areas like BIM and construction management. Despite this strong competition, Nemetschek differentiates itself through its OPEN BIM approach, diverse product portfolio, and a focus on providing interoperable, specialised tools tailored to specific needs.

Pricing Power and Barriers to Entry

One of the most resilient forms of pricing power is when a company's product is both heavily relied on by customers and represents a low cost. In the event that a customer looks to cut costs, their reliance on the quality of the product means they are unlikely to take a risk to find an alternative, particularly if it represents a small fraction of total expenditure and therefore would make little difference to the bottom line anyway. Nemetschek benefits from such a form of pricing power.

Nemetschek has an established reputation, comprehensive portfolio of products and is deeply integrated with their customer's workflows. The company's software is often considered mission-critical, giving it leverage to maintain a premium pricing. Given that 90% of construction projects come in over budget and that 20% of materials are wasted, Nemetschek's products (when properly utilised) can increase efficiency and lower cost.

Growth

Nemetschek expects to see growth across all four of their business segments. Design is expected to continue growing over the near-team at 9%, Build at 15%, Manage at 9% and Media at 12%. The company's growth is primarily driven by population growth and urbanisation, both of which are fueling demand for housing and infrastructure. The construction industry in particularly is fairly behind on digitisation, meaning there is a lot of white space for growth.

Building information modeling (BIM) is the process of creating digital representations of buildings and infrastructure. Regulation is increasingly mandating the use of BIM for state funded construction, which is a helpful regulatory driver of growth for Nemetschek.

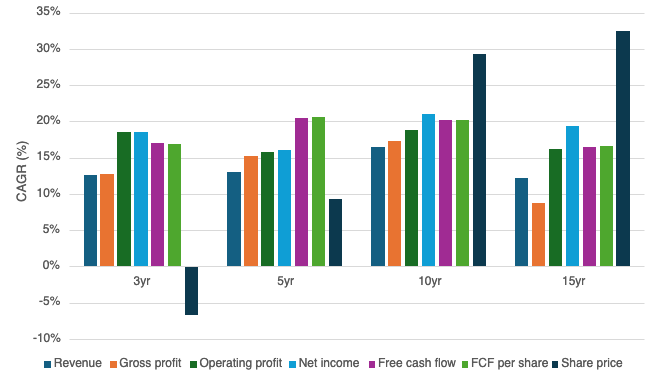

Nemetschek has seen consistent top to bottom growth. Revenue grow is consistently above 10% per annum and free cash flow per share growth is consistently above 15%. This has often translated into double-digit share price growth, although not in the last few years - suggesting a rerating, making the company more attractively valued.

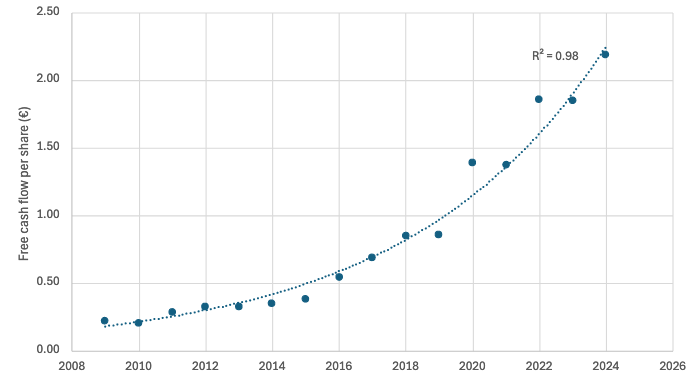

Nemetschek's mostly SAAS-derived revenue, means growth is impeccably consistent. FCF per share growth has grown 17% per annum over the last 15 years, which when fitted with an exponential curve, has an RSq value of 0.98 (note that the closer the value is 1.00 the more perfect the correlation).

Margins

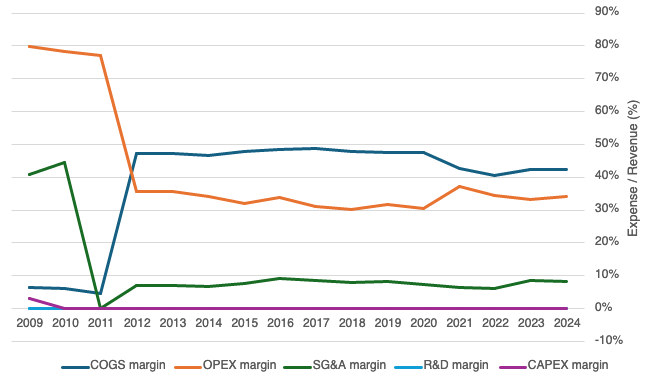

Nemetschek is clearly a company that has its expenses under control. The below chart breaks down its expense margins. Cost of goods sold (COGS) and operating expenses (OPEX) have been fairly flat over the last decade.

Capital allocation and capital efficiency

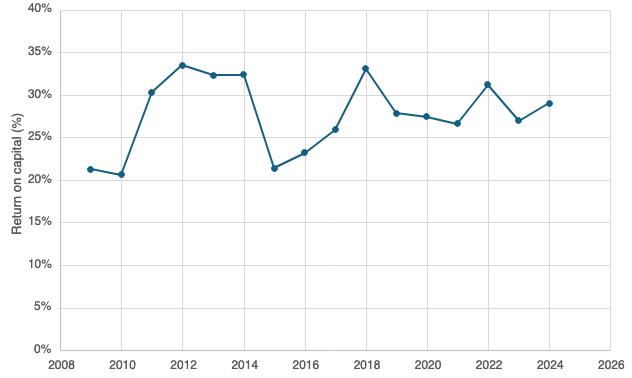

Nemetschek has been fairly consistent in keeping its return on capital above 20%, and since 2017, they have kept it above 25%.

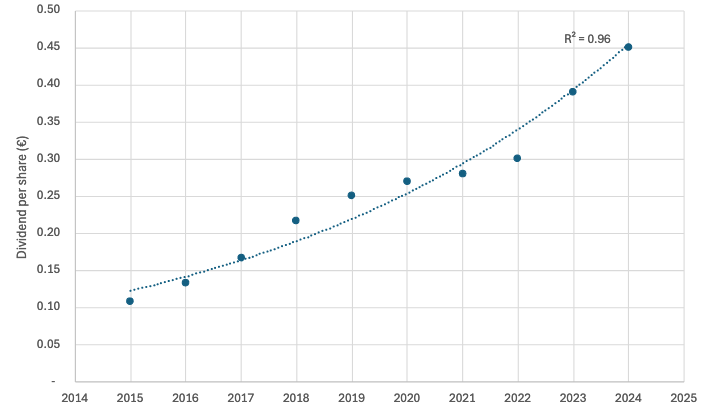

Nemetschek consistently retains its profits to reinvest for future growth. Their dividend payout is typically around 20% of free cash flow. Over the last 15 years, the dividend has grown at a similar rate to FCF (over 15% per annum), with an exponential RSq of 0.96.

Balance sheet strength

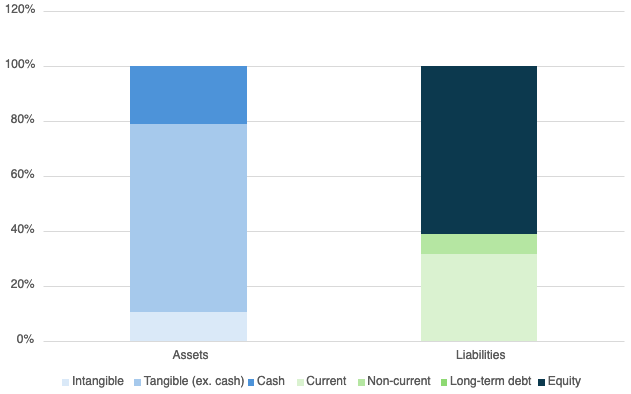

Nemetschek has a fairly robust balance sheet. Approximately 21% of assets are cash. Approximately 61% of the balance sheet is equity, with minimal levels of long-term debt.

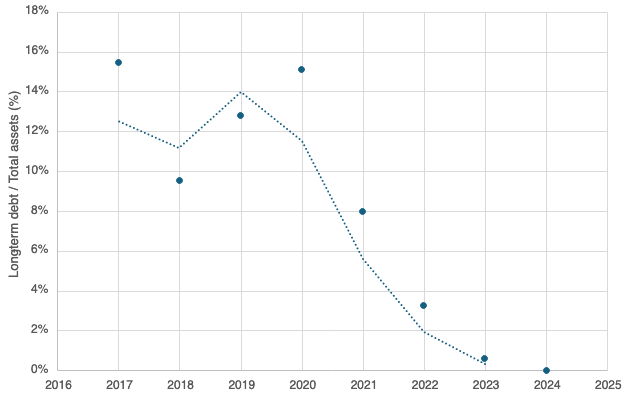

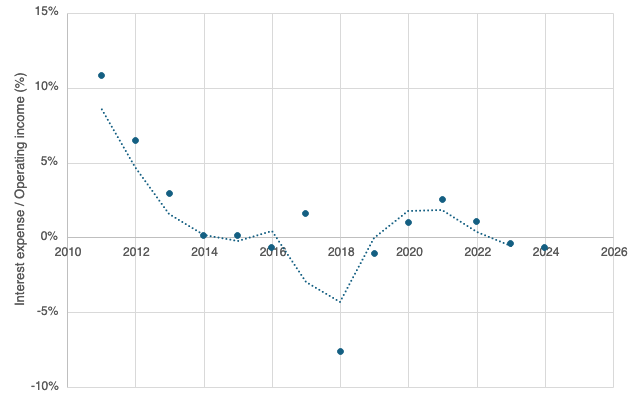

Long-term debt as a percent of assets has plummeted over the last few years.

This has led to the interest the company pays on its debt also dropping.

In short, Nemetschek's cash-generating pricing-power fueled assets are conservatively financed by a robust balance sheet.

Valuation

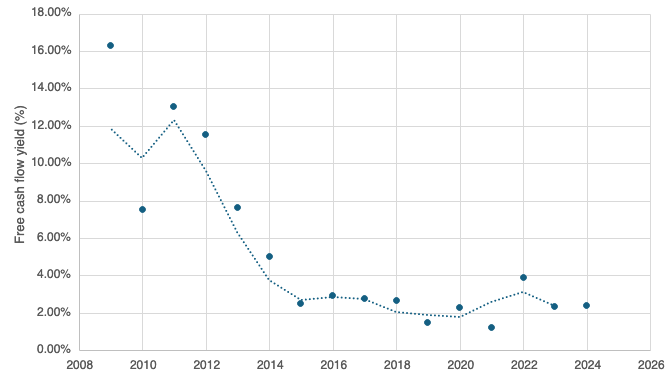

FCF yield trend

Unsurprisingly, a company of Nemetchek's quality has seen its FCF yield decline over the last decade. Although it has been fairly flat since 2015.

What has moved the share price in the past - growth or valuation?

Over the last 5 years, Nemetschek's share price has grown by 9% per annum, compared to a FCF per share growth of 21% per annum. So free cash flow growth has significantly outpaced share price growth, demonstrating that recent returns have not been driven by the company becoming more expensive. In fact, the FCF yield has actually risen from its 2019 low of 1.46%, to its current yield of 2.39%.

Is a realistic amount of growth required to reach a more attractive valuation?

Assuming the share price stays the same over the next 5 years, FCF per share would need to grow by 7% per annum in order for the FCF yield to equal the S&P 500's current earnings yield of 3.40%. Over the last 5 years, Nemetschek has grown its FCF per share by 21% per annum, so such growth could be feasible. There are two interpretations of this. Either less growth is required in the future to justify the current price, or the market is pricing in less growth for the future. The latter seems unlikely given Nemetschek's long-term drivers (population growth and urbanisation), SAAS business model, predictable FCF growth over the years, high returns on capital and wide margins.