🛰️ Three under-the-radar linear compounders

Number 1: Paylocity (NASDAQ:PCTY)

- Business: Paylocity sells cloud-based payroll and human capital management software. They sell to businesses of all sizes, primarily in the US. They have a market capitalisation of $12bn.

- Growth: Over the last 5 years, their revenue has grown 25% per year and FCF per share has grown 29% per year. SBC is quite high at 34% of operating cash flow.

- Capital efficiency: The cash return on capital is currently 27%. CAPEX is currently 19% of operating cash flow. Interest expense is 0% of operating profit.

- Valuation: The FCF yield is currently 4.18%. The P/E ratio is 53.72.

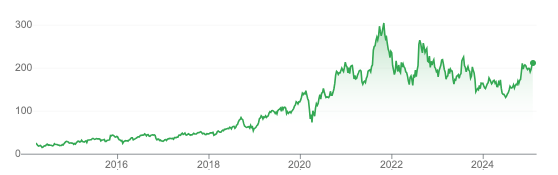

- Price: Share price has compounded 23.7% per annum over the last 10 years with a linearity of 0.90. Shares are currently down 31% from their 2021 high.